What is a Statement of Adjustments?

The Statement of Adjustments is a statement issued by the seller which sets out the exact amount that the buyer should pay to the seller in order to complete the transaction.

How is the Statement of Adjustments prepared?

The Statement of Adjustments is typically prepared by the seller’s lawyer and reviewed by the buyer’s lawyer.

At the time of entering into an Agreement of Purchase and Sale, the purchaser often pays a deposit to the seller’s Real Estate Brokerage. This amount is usually set out on the first page of the Agreement of Purchase and Sale. You might suggest that in order to calculate the exact amount owing to the seller on closing, you should simply deduct the deposit paid to the seller from the purchase price. This answer is partially correct but it does not take into account what we refer to as “adjustments”.

Adjustments refer to certain calculations relating to pre-paid expenses for the property. An example is condominium fees. Condo fees for every month are paid at the beginning of that month and therefore if the closing is scheduled for the 23rd of the month then the seller likely has already paid the entire condo fees for that month at the beginning of the month. This means that the seller has overpaid for the last 7 days of the month which are the responsibility of the buyer. On the other hand, if the seller has failed to pay the condo fees for the month, then the buyer is owed 23 days of condo fees. A similar calculation is completed for property taxes. The seller is responsible for payment of property taxes up until the closing day. Property taxes are however often paid in installments and as a result, on the day of the closing it almost never is the case that the seller has paid exactly the amount that it should have paid. In these circumstances the seller has either overpaid, in which case a credit will need to be given to the seller or the seller has underpaid, in which case a credit will need to be given to the buyer.

The credits for these pre-paid expenses are usually reflected in a document called Statement of Adjustments. A typical Statement of Adjustments usually looks like this:

Any credit that should be given to the seller will appear in the “Credit Vendor” column and any credit that must be given to the buyer will appear in the “Credit Purchaser” column. The amount that is calculated appears right in front of “Balance Due on Closing”. This is the exact amount that the buyer will have to pay to the seller on closing and this is how it is calculated:

Balance Due on Closing = Sum of All Credits to Vendor – Sum of All Credits to Purchaser

In the example above, the Balance Due on Closing is calculated as follows:

Balance Due on Closing = $1,249,000.00 + 687.19 – $150,000

Now let’s take a look at the calculation of the property taxes in the above example which has resulted in a credit of $687.19 to the seller. As you can see the total taxes for the year is $6,226.39 and the seller has paid $5,565.95. The first step is to calculate the amount that the seller is responsible for. In order to do this we must count the number of days between January 1 and the closing date, in this case, October 14. You can do this by either counting the actual days on the calendar or you can use an online service such as Time and Date. Upon completing this calculation we note that there are 286 days between January 1 and October 14 and therefore the seller is responsible for 286 days of property taxes. Now we should calculate the daily rate for property taxes. We know that the taxes for the entire year are $6,226.39. Upon dividing this number by 365 we arrive at $17.05860273972603 as the daily rate for property taxes. We will then multiply this number by 286 and arrive at $4,878.76 as the amount that the seller is responsible for. In our example we note that the seller however has paid $5,565.95 towards taxes prior to closing and as such the seller has overpaid by $687.19 and must be given a credit in that amount accordingly.

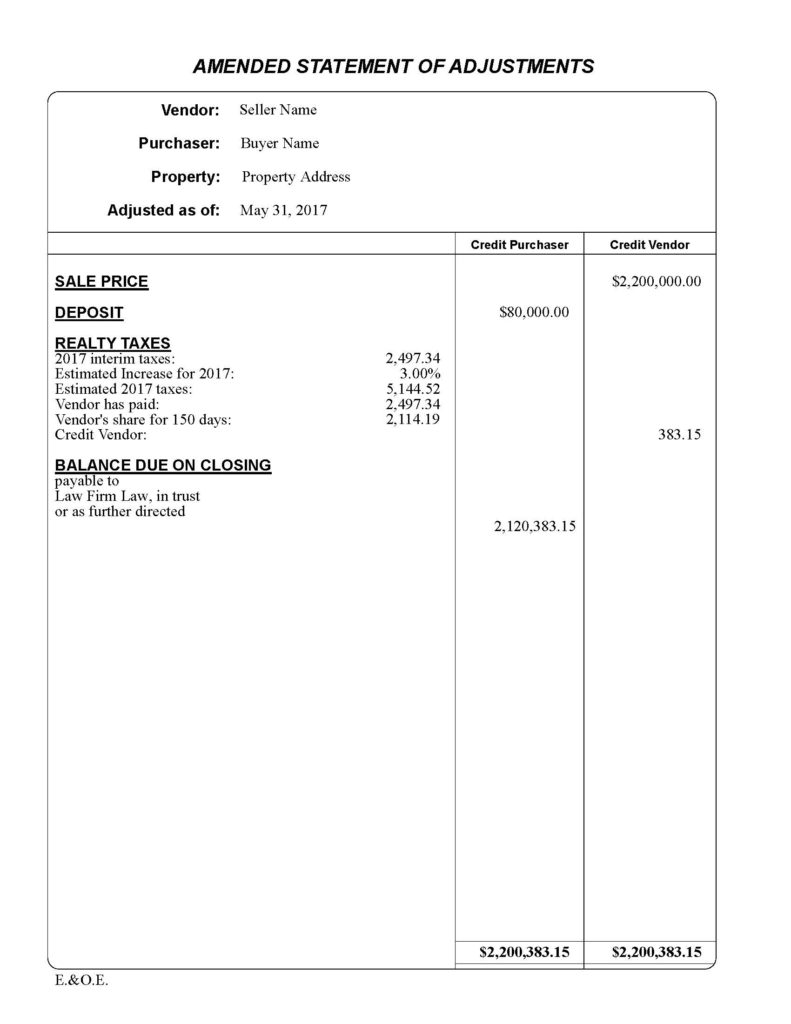

With respect to the adjustments for Property Taxes or Realty Taxes, you should note however that there are two types of bills that are relied on: Interim Tax Bills and Final Tax Bills. An Interim Tax Bill is issued by the municipality during the first half of the year when the final increase to that year’s taxes has not been determined by the municipality. In these circumstances the municipality takes last year’s Final Tax Bill amount and divides it by two to arrive at the Interim Tax Bill amount for the current year. In the second half of the year however, the municipality finalizes the amount that is going to apply as the increase to the current year’s property taxes and issues a Final Tax Bill for the year. This being said, the basis for the calculation of the taxes will depend on whether the closing is taking place during the first or the second half of the year. If the closing is taking place in the second half of the year, then likely a Final Tax Bill is available, which can serve as the basis for providing us with the exact number that is the total property taxes for the year. If the closing is taking place during the first half of the year though, likely only an Interim Tax Bill is available. To complete the adjustments on the basis of an Interim Tax Bill usually the seller’s lawyer will account for an estimated increase for the year (typically in the amount of anywhere between 3% to 5%) and will apply that increase to the number on the Interim Tax Bill and will multiply the result by two in order to arrive at the estimated taxes for the entire year. In both cases, once the total taxes for the year are determined, that amount is divided by 365 and multiplied by the number of days from January 1 to the closing date to determine the amount that is the responsibility of the seller which is then compared with the amount that the seller has actually paid in order to determine if a credit needs to be given to the seller or the buyer.

Here is an example of a Statement of Adjustments with Property Tax calculations on the basis of an Interim Tax Bill:

When the taxes are calculated on the basis of an Interim Tax Bill on closing, you might wonder what happens when the Final Tax Bill is later issued by the municipality to the buyer and it turns out that the amount of the increase applied to the taxes for the year is more or less than the estimated increase accounted for in the Statement of Adjustments. As part of the closing, the buyer and the seller provide each other with an Undertaking to Readjust, which is in essence a promise to make corrections to the Statement of Adjustments after closing, in the event any of the numbers on the Statement of Adjustments turns out to be inaccurate. While it is very uncommon for either of the parties to contact the other to ask for a readjustment upon receipt of a Final Tax Bill, this is something that the buyer and the seller have a right to on the basis of the Undertaking to Readjust received from the other party.

Adjustments for New Condominiums

If you are purchasing a new condo you should note that developers often add fees to the Statement of Adjustments for items such as Hydro, Gas, Electricity, Water, Common Expenses, Reserve Fund, Site Review, Education Levy, Parks Levy, Section 73 Contributions, Development Charges, Installation of Meters, Administration Fees, Tarion Fees, Legal Fees, Law Society Levies. These amounts can add up to a significant amount which will impact the calculation of the amount that will have to be paid to the seller on closing. In extreme cases, we have seen these additional fees add up to approximately $25,000. You should also note that the amount appearing on your Agreement of Purchase and Sale with the developer, assumes that you qualify for the New Housing Rebate. The Agreement often provides that the developer at its discretion may decide not to apply the rebate. If this happens, there will also be an additional amount payable by you which can be approximately $25,000. If this happens and your position is that you qualify for the rebate, you can apply after closing to get this amount back from the government.